As of 2014, the median price of a home in the U.S. was $188,900. With 8 in 10 Americans finding themselves in financial debt, it’s hard to imagine very many people being able to purchase a home.

Saving for a down payment on a house can be a daunting task, but it’s definitely doable with a little planning and effort.

In this post, I’m going to share some tips on how to save up for a down payment on a house, even if you don’t have a lot of money to start with.

Here are a few things you can do to save for a down payment on a house:

- Set a goal. How much money do you need to save for a down payment? Once you know your goal, you can start to create a plan to reach it.

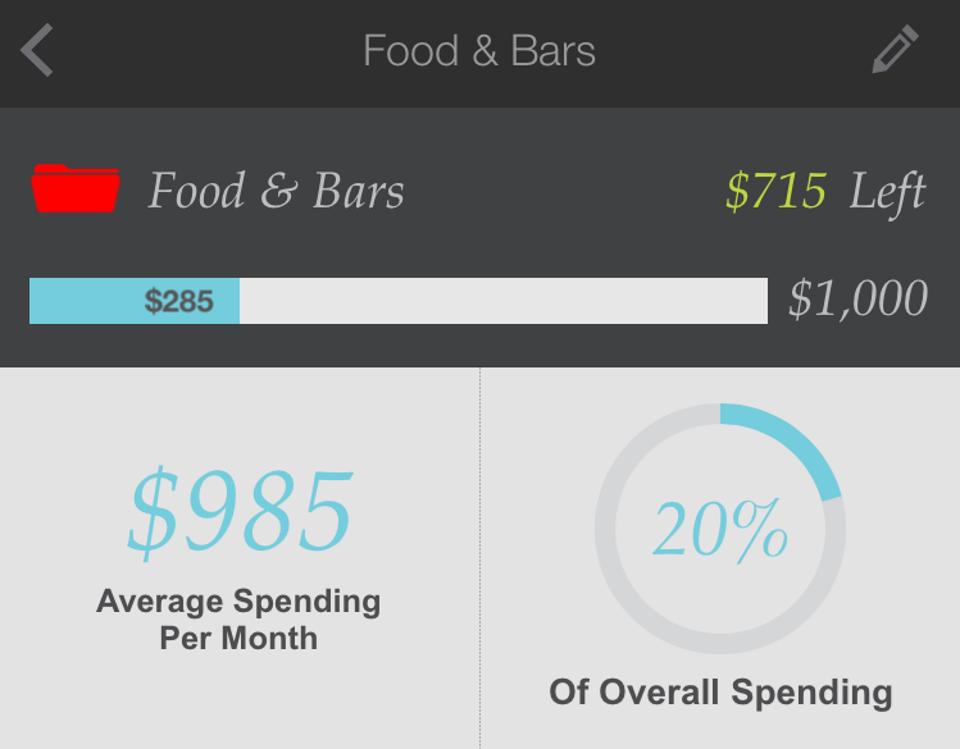

- Make a budget. This will help you track your income and expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to free up more money for your down payment savings.

- Cut back on unnecessary expenses. Take a close look at your budget and see where you can cut back. Are you spending money on things that you don’t really need? If so, start cutting back on those expenses so that you can save more money for your down payment.

- Increase your income. If you can, find ways to increase your income. This could mean getting a part-time job, starting a side hustle, or asking for a raise at work.

- Automate your savings. One of the best ways to make sure that you’re saving money for your down payment is to automate your savings. This means setting up a system where a certain amount of money is automatically transferred from your checking account to your savings account on a regular basis.

- Don’t touch your savings. Once you start saving for your down payment, it’s important to resist the temptation to touch your savings. This means not using it for unexpected expenses or for things that you don’t really need.

- Be patient. Saving for a down payment takes time and effort. Don’t get discouraged if you don’t reach your goal overnight. Just keep saving and eventually you’ll reach your goal.

Your credit history, annual salary and the cost of real estate will play a vital part in the affordability of your next home. Generally, using a real estate CRM, real estate agents can help you find a home in your budget. The thing is, you have to establish what your budget is before you start looking at houses on the market and making bids.

Best Cities to Own Real Estate in 2017

No matter how tempting it is to just go out there, find a house and make it yours, spending your hard-earned money willy-nilly could result in your new home’s foreclosure; nobody wants that.

If you’re looking to buy a new home but are unsure of how to budget, here are a few more ways to get started:

Add Up Your Income

12 Free Apps To Track Your Spending And How To Pick The Best One For You

The first place to start when creating your home-buying budget is by adding up your income. Businessman Dave Ramsey tells homebuyers that they should start the budgeting process “by adding up every source of income that comes into your checking account each month.”

After the income is tallied, it’s time to write down your monthly expenses, like so:

| Groceries | Electricity | Internet | Insurance | Incidentals |

| $_______ | $_______ | $_______ | $_______ | $_______ |

The expenses you spend here will help you get a better idea of the wiggle room you really have in your total budget.

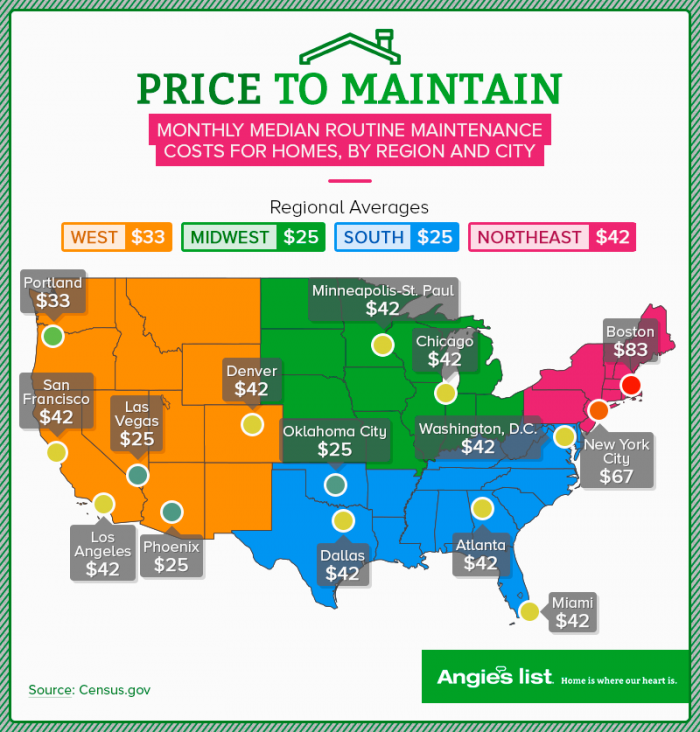

Total Up Home-Ownership Costs

12 Hidden Costs of Homeownership

After totaling your monthly expenses, subtract that number from your total monthly take-home income. If you can’t buy your new home outright, Dave Ramsey advises prospective buyers to “keep [their] mortgage payment to no more than 25 percent of [their] monthly take-home pay on a 15-year fixed-rate mortgage.”

Mortgage Lending

If, after looking at your budget, you realize that you’re going to need a little help putting a down payment on the house of your dreams, HGTV suggests seeing a mortgage lender about mortgage prequalification. Mortgage prequalification is when an individual thinking about buying a home meets with a mortgage lender to discuss their finances, including but not limited to their annual salary, monthly income, assets and debt and other loans.

After crunching the numbers, the lender determines whether or not the buyer will qualify for a mortgage loan. If you made sure to build your credit and get everything in line, you should get an approval.

Before even looking at houses on the market, meet with a mortgage lender first to discuss your financial details. The last thing you want is to fall in love with the perfect house, to go to mortgage lender and be denied a loan. As a rule of thumb, don’t look at houses you think might even be remotely out of your price range; it will only break your heart if you have to say goodbye to house you had already begun imagining making memories in.

After learning through the mortgage lender what you qualify to borrow, it’s time to go back to looking at your monthly expenses and determine where (if anywhere) you can trim the budget.

The Cost of Homeownership

How Much Does It Really Cost to Own a Home?

It’s important to keep in mind that the money spending doesn’t stop after the house has been purchased. You’ll have new expenditures to deal with, including but not limited to homeowners’ insurance, HOA fees, trash and water fees and other incidentals. For instance, you might be charged a monthly bill to keep your motorcycle parked on the street in front of your house.

By setting a budget and sticking to it, and with the help of a mortgage loan, you can own your own home: what an accomplishment that would be!