Debit or credit, cash or check, pay with your phone, pay with Paypal, use a gift card. There are tons of choices to pay for stuff in today’s world. It’s possible for somebody to now go their entire life without touching a physical dollar bill.

But every type of digital payment has its own benefits and negatives. Some are more secure, but less convenient, while others have extra advantages like cash back or discounts. To help you get the most out of your payment approach, here are pros and cons of many popular and growing methods, and the impact they can have on you.

Traditional: Debit and Credit Cards

The tactics most used and popular, debit and credit cards are used in a majority of purchases. In 2012, 47 million transactions were done with debit cards alone. It’s clear that they will have a firm hold on digital payment for years to come and are accepted nearly everywhere.

Can a phone replace your wallet? I went shopping to find out.

With debit cards, the benefits are clear. It pulls money directly from your bank account to pay quickly and effectively. There is no worrying about paying a bill later or surprise fees, outside of maybe an overdraft fee. Aside from the simplicity of it, debit cards don’t have any extra benefits accompanying them.

Credit cards work as a short term loan from an institution that you have to pay off, typically in a monthly fashion. It means you can hold onto your money and have better control when it leaves your account. That way, if you need to purchase something but lack the funds then, you can put it off till you get your next paycheck. A major downside though is that if you miss a payment, not only do you owe money, but it damages your credit score.

Some credit cards have extra bonuses like cash back, earning airline miles, or discounts at specific stores. These benefits, if done correctly, bring a lot of value to credit cards if you work towards a goal.

Secured Credit Card

The 5 Best Secured Credit Cards

While debit and credit cards are simply and well known, there are other solutions that are better for some people. A great example of this is somebody who has poor credit. Yes, they can get a debit card through their bank, but with bad credit, they can’t qualify for a credit card.

Luckily, a secured credit card is a great form of payment people with low credit can use. It acts like a debit card, pulling money directly from a bank account, but reports to the companies in charge of credit scores like a credit card. It’s impossible to miss a payment with one, so all it can do is build your credit with every purchase you make.

Paypal

PayPal vs. Venmo vs. Square vs. Google: Who makes the best app for sending cash?

Using debit and credit cards are great for shopping with trusted businesses, but sometimes you have to make purchases online from what might not be the most reliable places. Paypal brings several features to the table when it comes to buying online.

The first is that it protects your financial information, including credit/debit card info. If you have to do business with a stranger, paypal lets you send money without putting yourself at risk.

If something goes wrong in the transaction (like you never get your purchase or it’s broken) you can easily get your money back through Paypal too, especially if you use it with online retailers like eBay or Amazon.

Mobile Wallets

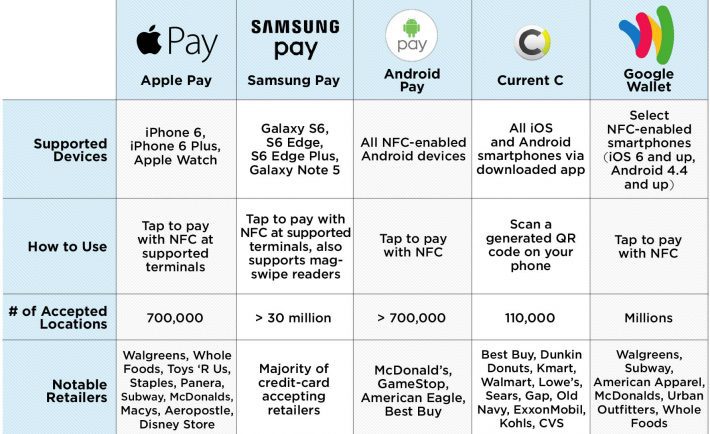

Mobile Wallets: Apple Pay vs Samsung Pay vs Android Pay

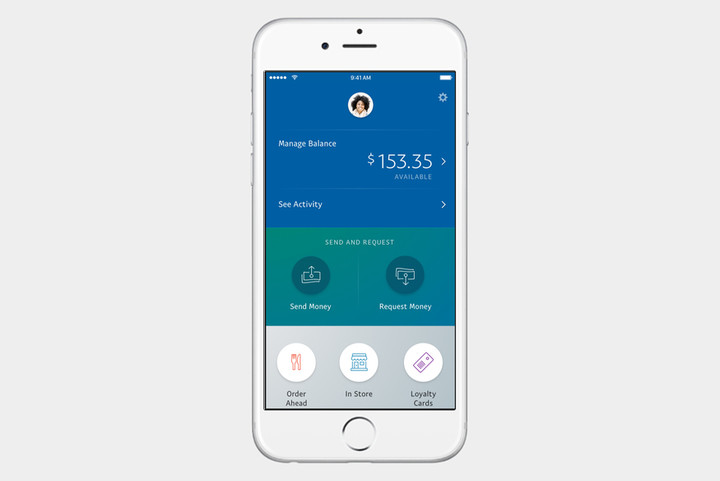

Smartphones are impacting the world as we know it daily, and how you buy stuff is no exceptions. Payment apps like Apple Pay and Google Wallet let you pay at physical locations with your phone. Similar to paypal, it protects your credit card information by simply wiring the money to the seller, but works at physical store fronts.

Along with the extra security, this payment option is helpful to people who don’t like having to pull out their wallet or when people forget their wallet but need to buy something. If you already have your phone out, might as well use it to pay.

A major downside to paying with your phone is that it isn’t widely implemented by stores. Many major retailers and chains accept mobile wallets, but smaller stores might be slow to adapt to it. Hopefully with time, that won’t be an issue as mobile payments become more popular. Another problem worth mentioning is that your phone runs on a batter and if it dies, you’re out of luck and money.

Protecting Yourself

Whatever digital payment tool you decide to go with, make sure to protect yourself. No method is one hundred percent safe from criminals and hackers, so always keep an eye on your financials.

How to protect your financial apps from getting hacked

Got a question or insight you want to share? Let us know in the comments below!