Americans rarely carry cash anymore, and why would they? Nearly every restaurant, store, shop, stand, and cafe in the world accepts credit and debit cards. A 2014 study found that two out of five Americans carry less than $20 in their wallet, and nearly one in 10 carry no cash at all. While there will always be the cool burger joint or local shop that’s cash only, the need for paper currency is nearly obsolete, and now we have a new device to push away the old methods even further — our cell phones.

A myriad of smartphone apps connect with credit cards, debit cards, and bank accounts to make payments at stores, online websites, and even peer-to-peer cash transfers. It’s quickly becoming one of the most popular ways to pay and major tech companies are rushing to capitalize on this new financial market.

Security

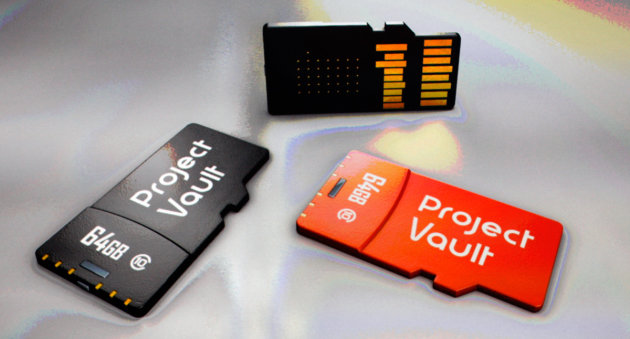

Google’s Project Vault secures your devices with a microSD card

Mobile security is a big concern when your money is involved. Every app listed ensures customers with its own levels of security, but the unfortunate truth is no system is 100 percent secure. Your best bet is give your business to the company you trust most, and even look into identity theft protection as an extra layer of security. That is the reality of convenience in 2015.

Apple Pay

The ultimate guide to how and where to use Apple Pay

Apple makes the world’s most popular smartphone, it’s only natural it also makes what has quickly become the world’s most popular mobile payment system. Apple Pay uses a signal called Near Field Communication (iPhone 6/iPhone 6 Plus only) to act as a digital credit card between the iPhone and a point of sale at a store. The user authorizes the purchase by holding the iPhone up to the POS and using a fingerprint for security. Not every company/location is equipped to accept this form of payment, but many are jumping on board as Apply Pay keeps booming.

Android Pay

Google confirms Android Pay: a mobile payments layer ‘anybody can build on’

Google can’t be happy about Apple Pay, since it was actually the search engine giant who debuted the technology years earlier. Google Wallet made NFC payments through capable Android phones but never took off the way Apple Pay did this year. Google is out to change that with the new and improved Android Pay. The system works just like Apple Pay — connects with credit cards, uses NFC and requires a passcode of thumb print to authorize — but Google wants this to be a standard to all Android phones and is throwing in extra features to compete with Apple. For example, Android Pay works with rewards accounts automatically, like MyCokeRewards if you buy a soda at the vending machine.

Award Wallet

Google may be set to leapfrog Apple in mobile payments with Android Pay

Wallets aren’t just for dollars and cents. Frequent travelers juggle dozens of award accounts and possibly millions of airline miles and hotel points. Award Wallet helps organize those accounts and keeps users up to speed with member statuses, account balances, and notifications if points are set to expire. It’s an absolute must-have for anyone who travels often for their career.

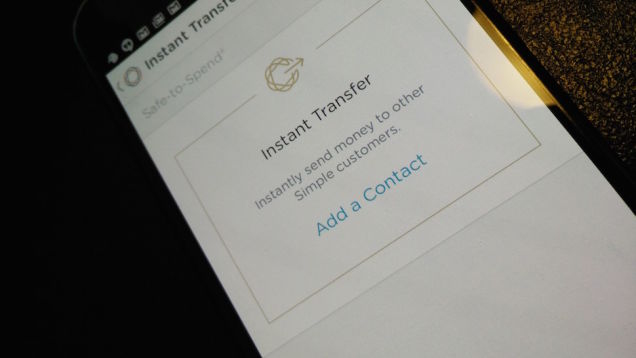

Venmo & Square Cash

Which Online Money Transfer Service Is the Most Secure?

Peer-to-peer payments are a big part of the mobile money industry. Next time a friend owes you $20 for gas, don’t wait around for them to get cash from an ATM. Both Venmo (owned by PayPal) and Square Cash link to a debit card or bank account to send and receive cash. Venmo takes a day or two to transfer to your bank account, but Square Cash transfers in real time and the balance is available instantly.