You have to pay your bills (there’s no way around that part, sorry), but you don’t have to let them drive you crazy. Bills aren’t just infuriating because they’re pricey – they’re infuriating because there are so many of them, and they are so easy to forget. There are passwords to online portals and bills in the mail and bills that you pay automatically, or at least you think you do, though you can’t remember the password and now you can’t check. You can’t miss payments, though. You need to pay your electrical bill and your credit card bill and the mortgage on your home in Cincinnati.

Don’t worry – you can manage your bills. Here’s how.

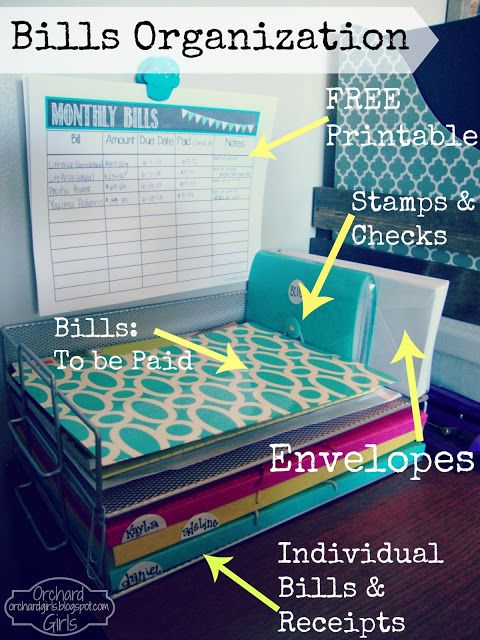

Everything in one place

Best 25+ Bill organization ideas

Let’s start with the obvious: you need a list of your bills. All of your bills.

You can do this on the computer, with a pen and paper, or however you want to do it. The important thing is that you get down every last bill on a list. You should include a bit more than the name of the bill. Here are a few things to consider including:

- To – Who does the check made out to?

- Due date – Of course!

- Amount – In the case of changing utilities bills, jot down an average

- Method – Are you paying this bill by check? Online?

- Contact – Where is the check mailed? What’s the company’s website?

You may also want to include the login information for the relevant websites. Don’t include your passwords if you’re making the list on a computer (especially if it’s a laptop or mobile device). You may, however, want to jot down the passwords if you’re working with pen and paper. While you need to be careful with passwords, a physical list in a safe place will be secure. You’ll only be at risk if your home is broken into and the paper is found, and even then, most of your billing profiles won’t include anything that you don’t hand over to a waitress every time you pay for a meal!

Calendars and manual payments

Now that you have a master list of your bills, it’s time to make a schedule. Not every bill needs to be on your schedule, because you may have auto-pay set up for some of them. But for bills you pay manually, a schedule is essential.

Paying bills on time is vital. You could deal with late fees or lose insurance coverage if you delay! Your bills are payments you make in exchange for vital services – from electricity to Medicare supplement insurance – and less vital ones, like Netflix (which is still pretty important to some of us!).

There are a few ways to do this. You can use analog methods, like a list of dates or a physical wall or desk calendar. Or you can use apps, including reminder apps, to-do list apps, and calendar apps like Google Calendar.

The key is to use one method for all of your bill scheduling: one calendar, one app, or one other method you come up with. You’ll have the master list and your one scheduling system, and that’s it!

Auto-payment dos and don’ts

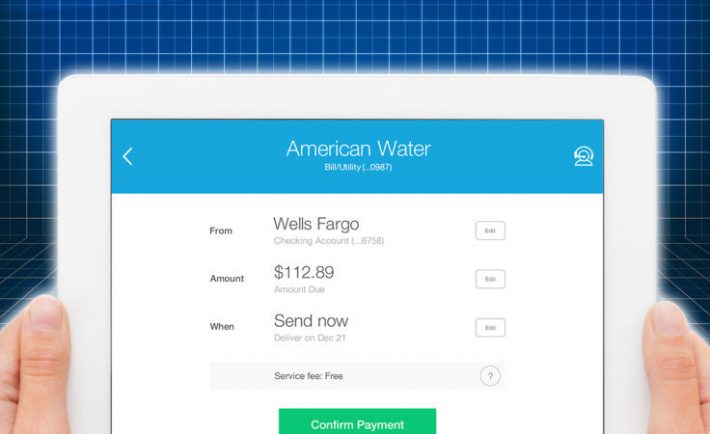

How I Used Mint Bills to Finally Simplify My Bill Payments

You can keep bills off of your calendar with auto-payment, which will handle everything for you. But there are a few things you need to keep in mind!

First, be aware of overdrafts. Auto-payments can get you in trouble if your checking account is low. Using a credit card is an option if you’re good with credit – otherwise, just be careful about how much you keep in checking, or choose to pay bills manually.

You also need to remember to change your auto-billing information when you change credit cards or banks. You can’t pay bills with an expired credit card! That’s why it’s important to keep your master list from the first section – when you get a new credit card, just run down the list, visit the relevant websites, log in, and change the payment information.

Auto-payment makes paying bills a whole lot easier. But you still need to be organized to keep everything running smoothly!