In most instances globally, there’s a possibility of increased cases of online money-related scams. People are likely to engage more in financial misconduct rates. It could be due to the hardships they go through following the effects of the pandemic. For instance, many lose jobs, businesses go down, among other factors leading to a lack of income. An epidemic causes panic and uncertainty amongst individuals. As a result, scammers and fraudsters take advantage to make fortunes. They mainly use targets such as fake online companies, emails, telephone calls, and others to con people. Did you notice a rise in the companies offering? Online loans are growing after the emergence of COVID-19? Well, this article discusses how to fight online money scams amidst pandemic. Keep reading on about the type of scamming techniques and ways to avoid these.

Email phishing

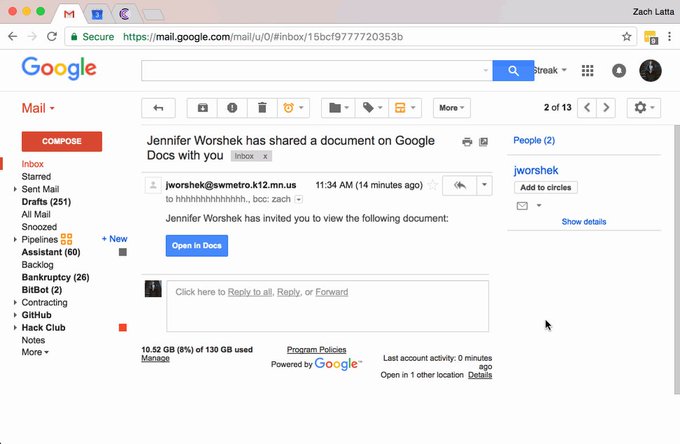

Phishing is a common online scam involving scammers reaching out to phish for your financial details. During a pandemic, people tend to visit the internet, searching for more details to stay informed. You get to a website and notice a document seeming to come from a legit lender know more about it by visiting Instant Loan.

It even becomes more appealing when you speak to a caller asking you to confirm your loan details. In case the scammers succeed, you’ll be asked to provide information, including your bank account number and passwords, social security number, and other relevant information that will be used for stealing your cash.

The best way to avoid the phishing scam is by confirming the website you’re using is encrypted. This is a crucial rule when visiting a page to apply for an online loan. Double-check the farthest left side of the tab and notice a security key starting with ‘https’- shows the site is secured. Without that, don’t take any risks because the site may be illegitimate. In short, stop clicking links from popup windows and unwelcome emails. If you come across an untrusted email or call, it’s better to contact the lender’s customer care service to inquire about the contact. Again, if that fails, find another option instead of taking risks. You better not get the loan rather than risk losing your identity and getting a drained bank account.

Advanced charges for loan approval

This kind of trick mostly goes hand in hand with phishing. Here, one applies for an online loan and is asked to pay some fee for maybe insuring your loans, covering processing charges, or a guarantee for approval before application. In most cases, you’ll be asked to make such payment through ways that can’t be traced for reference- in their favor. You do this, and you’re already not having enough. That means you’ll lose the upfront fee and not get a loan as thought.

You can fight the upfront fee scam by putting your application on hold in case the lender asks for the advanced charges. Be informed that a legitimate lender never asks for money before your loan application is processed. Honestly, there are lender organization that ask for this amount, but the money is primarily deducted from your loan. Check out for these online cons.

Lottery frauds

Have you ever received a text saying you won a lottery you never participated in? Yes, ‘winning a lottery’ is one of the most common scams, especially when people are desperate due to a pandemic. You may as well be told to give payment for ‘releasing’ the amount won. Usually, it’s a tremendous amount that can easily lure you into falling for the trap. They’ll further ask for your details for verification; later on, you realize it was a scam. Some of the lottery scams’ indicators include an individual’s email instead of a company’s, several recipients, or it may be a new type of lottery.

When such happens, quickly get to Google and search to confirm the legitimacy of the lottery name- it’s never legit. People would wish to obtain such luck in life- winning a lottery; when you never bought a ticket to play the game. For this reason, don’t expect to win. Remember, anyone asking for your details related to your account, especially online, is likely to be cons. Never trust huge sums of money for free.

Charity scams

After the adverse effects of a disaster or pandemic, humans become very emotional and want to offer help as much as they can. However, scammers are always smart and take advantage to capitalize on the situation. They may create donation websites and accounts for sending emotional texts for soliciting funds to help the ‘affected.’ Fortunately, it’s mostly successful since it’s based on sympathy.

People are always willing to donate when touched by a situation as a show of humanity. But, it’s essential to confirm the claims. Research shows that such sites are ensuring they’re affiliated with the allegations. Give patience to your kindness by not donating to any sites looking suspicious. An official charity website will have a stated mission plus other tax-free documentation.

Beneficiary tricks

Let’s say you receive an email from someone claiming to transfer millions of money. They ask you to help them move out of the country for some profit of the total. Every detail is given for enticing you to think it’s legit. However, this money is delayed, and it’s you to facilitate everything as you await the procession of the funds. You undoubtedly do as asked with a thought of trying your luck, and in the end, realizing it was a scam.

There are signals to determine if it’s a scam or not. Countercheck the email or messages sent. Any grammatical mistakes and unprofessional writing are a warning sign to avoid such traps. If a deal is too good, more so, online think again.

The Bottom Line

Pandemics are a great beginning to online money scams and frauds. People use the desperation caused by a disaster and epidemics to trick others. For instance, they use tricks such as emails claiming to offer a loan, charity donation sites, beneficiary frauds, email phishing, upfront fee payment for loan procession, lottery scams, and so on. People need to be keen by watching out any red flags. Your instincts may be right. Treat any suspicion with a lot of care to avoid falling for scammers’ traps.