Beware of blindly believing in the advice you receive from financial experts. They might not be authentic and honest about it. There are chances of their advices being blemished with biases, presumptions, motives for personal gains etc. Most people are oblivious to the deep-rooted issues that financial experts carry in their advices – knowingly or unknowingly. They are also unfamiliar of the fact that the information dished out by the financial experts is tainted by prejudiced intentions like meeting their target deadlines, desperation of selling the products etc.

The ingrained faults in the financial advisory system prove the fact that they can be inconsistent with their advices; one of the most common reasons being that they can be self-deluded, deceptive and discrepant. This makes it risky to solely trust the experts for financial advice. So there is no other way but to take charge and become an expert at managing your finances. Read on to find out about the truths that no one tell you about the financial industry.

What You See/Hear Might Not Be The Truth

Stocks are too risky, bonds pay too little. Where do I invest? Check out Dr Wealth App. for stock data.

Wearing an expensive suit and working with a well-known firm don’t prove anything about the expert’s reliability. There are so many compilations of evidences that prove the dishonesty of the financial planning industry. For example, Ed Beckley who wrote the book “Million Dollar Secrets” was imprisoned in 1987 for bankruptcy. Another well know author, Albert Lowry of “How You Can Become Financially Independent By Investing In Real Estate” was convicted for bankruptcy not pnce, but twice, in 1987 and 2003. In yet another incident, a customer sued the author Charles Givens for bad advice on financial planning. And all of these revelations were from a self published financial expert, John T. Reed who has a plethora of controversies under his belt.

Before you trust any financial expert or firm, it is necessary that you do your own due diligence incase an issue of conflict of interest arises. Failing to perform your own due diligence makes you less aware of the possible financial problems that may crop up in the future. However, not all financial advisors are dishonest, of course. Trust your instincts and do your own research and investigation thoroughly (check over here). Planning your wealth is more important than investing that same time in investments.

Spoon Feeding Of Financial Information Taints Your Rational Thinking

A Note to Investors: Don’t Blindly Rely On Experts’ Opinions

One of the dangerous consequences of blindly believing in financial experts is that it numbs your rational thinking capacity, which is a necessary skill required for investing. In a recent survey conducted by Gregory Berns, college students were asked to make a choice between a regular low paying job and a high paying unstable job. One of the two groups formed was given an expert for guidance on their decision making while the other group had to make a decision on their own without any help.

Students who were assigned an expert had opinions that depended on the expert’s advice while the other group of students used their critical thinking skills to reason themselves out. Berns stated that the critical thinking parts of the brain almost quit working in case of the group with an expert. People usually delude themselves into thinking that they are the ones making the decision with advices from the expert while what is really happening is the opposite of it. In addition, they also presume that the expert would know better than them. Therefore, it is essential that you don’t let your rational thinking power diminish. Master the art of going by your intuition.

False Information By The Financial Planning System

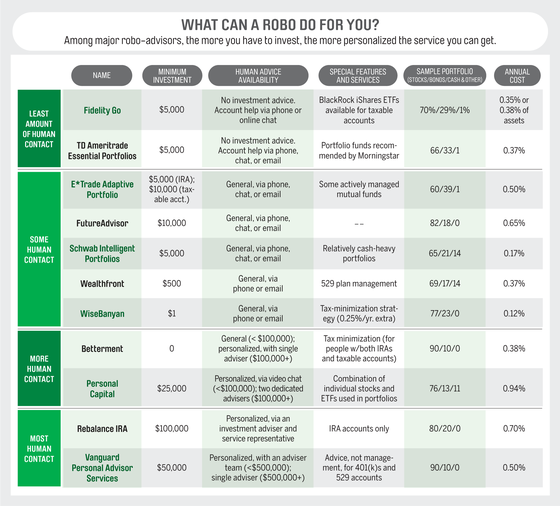

Everything You Need to Know About Using and Choosing a Robo-Advisor

Going by the definition of an expert, the financial planning market should ideally have inside out knowledge of finance. But recent researches have unfortunately proven otherwise. They also recorded the underperformance of mutual fund firms, which means that the experts heading the firms can’t really be trusted for their understanding of the markets. In yet another survey on predicting the future economies, economists made a false prediction on economic decline by stating otherwise.

Before putting an advice from an expert, say, CNBC, into action, ask yourselves a set of questions which will prevent you from committing lethal mistakes. Answers to questions like ‘how do I plan to track as to whether expert advice gets me good returns’ and ‘have I evaluated the risk factors and investment milestones in the context of the expert’s advice’ prevent you from making mistakes that can quickly come back to haunt you.

Incompatibility Of Different Parties In Decision Making

Don’t let emotions influence your investing decisions

The incompatibility amongst experts happens due to hidden selfish motives resulting in a conflict of interest. Make sure that you consider various factors like the advisor’s position in the firm, relationship between the advisor and the company, experience of the advisor in the financial field etc. Another major reason for conflict of interest is because investment firms incentivize the experts for getting higher investments in preferred instruments. Well known reporter Dan Dorfman was fired from his job for possible insider trading activities. No matter however reputed a firm may be, it can never be free of prejudices and conflicts of interest. Going by the information from the media, if a top notch investment banker and a well known columnist cannot be trusted, then no one can be trusted.

Then comes the hassle caused by the local brokers. The most common issue is falsely promoting stocks to people. This is done as a favor since the broker and the company holds a relationship. Some of the violations include unnecessary promotion of high cost products, recommending invalid products etc. To add to the inconvenience, certain conflicts of interests may not be immediately evident. The expert might seem unbigoted, but he sure must have a hidden motive.

Blindly Following An Investment Trend

Ten Rules for Trading Bitcoin, Ethereum, and Other Crypto

Although your broker might be genuine, you cannot wholly entrust him with your financial goals because most advisors blindly follow the consensus promoted by Wall Street, which may not necessarily workout for everyone. Many investors wrongly trust the standards and trends adopted by experts; they believe it like it’s the only way to go about investing, when it’s far from the truth in reality.

Buying for long term and holding on is a smart strategy for investment during the periods of market drops. However, this strategy doesn’t apply to every investor. It must be used only when it’s appropriate and in sync with financial goals. One of the major reasons why investment trends won’t last is because the experts do not think deeply about investing when the money is not theirs. They do not sell what the clients need, but they sell what they want. That’s why, in order to secure yourself financially, it is important to question the expert advice and develop your own viewpoint.

Final Thoughts

The list of reasons on why you shouldn’t trust anyone but yourself with financial decisions is endless. After discussing the causes, consequences, studies and various reports on stocks, investments and financial planning, it should now be clear to you on why it is the most important thing to form your own opinion about the investment market trends, future financial prospects etc.