Technology is constantly changing, and it can help you improve everything in your life, including your finances. For example, it can help you learn how to invest, use coupons, and budget. There are several ways you can put technology to work for your finances.

Get Your Finances in Order

There are many ways technology can help you get your finances in order, but one of the biggest ways is through student loan refinancing. It’s possible to research refinancing options online, and many lenders allow you to apply and go through the approval process online as well. Refinancing can help you lower your overall monthly spending because you are getting a single, new loan to pay back the existing debt.

Automation

Your time is likely limited, but technology is great at helping you save time. You are likely already familiar with direct deposit, where your employer can put your paycheck directly in one or more bank accounts. You no longer have to deposit a physical check in your bank. Take this one step further and automate savings from part of your paycheck as well. You can set things up, so a portion automatically goes to an emergency fund, a long-term savings account, and your checking account.

When you don’t have as much money in your checking account, you are less likely to spend more than you need. Automation also allows you to automatically pay at least the minimum on things like credit card bills. This prevents you from paying hefty late fees, which can dip into your earnings quickly. While automation can be convenient, it is still no substitute for closely monitoring your account. You should set up email and text alerts and regularly log in to make sure everything is running smoothly.

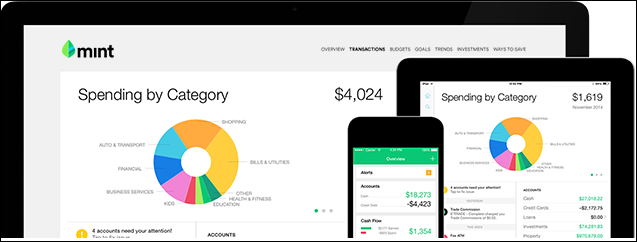

Use Online Tools and Apps

Online banking tools can help you improve your financial situation and prevent you from making costly mistakes, such as over-drafting your account. You might not be aware of all the features your bank offers, so take some time to learn about them. Many finical institutions have some type of online bill payment features. That means your bank will automatically take the funds out of your account and send them to the relevant provider. You can use it for everything from rent to utilities to credit cards.

There are also financial apps outside your financial institutions. These can help you invest, monitor spending, track receipts, and otherwise monitor your money. Many come in a fun, easy-to-use format, and there are so many out there, you are bound to find something to fit your lifestyle. Do your research to learn about the right apps to fit your financial goals. Online tools and apps can also help you stay informed and connect with other people. There are blogs and social media groups designed to help people learn how to manage their money. You can connect with like-minded people who also want to make the most of their money. Just make sure you are only sharing personal information with trusted advisors and institutions.