There are more amateur Forex traders around than ever. Nobody is entirely sure just how many, but it certainly runs into the millions. Today, it is simple to download an app and start trading, and a few weeks ago, we offered some guidance on choosing the best trading sites for burgeoning Wolves of Wall Street.

Knowing how and where to physically begin trading is a start, but it is not going to buy you that Ferrari and Armani suit. There is no getting around the fact that it is a complicated topic, and advances in technology have only added to the complexity. Perform a quick Google search, and you can easily come up with 20 or 30 different tools and indicators to guide your trading activities.

There are some well-worn and frightening statistics about the percentage of amateur traders who end up losing money, and when they do, it is invariably because they have not approached their trading activity armed with the correct tools, knowledge and strategy. Typically, it will go one of two ways: Either they install the app, throw some money into the trading account and start buying and selling almost at random, or they learn about 50 different tools, try to use them all and completely tie themselves up in knots.

There has to be a better way for a beginner to find his or her feet and make those first tentative trades without going to either extreme. It is with this approach in mind that we have selected the following short list of basic essentials that you need in your toolkit. Just like a plumber or an electrician, there are plenty more useful things you can add later, but these will get you started.

1) A clear strategy

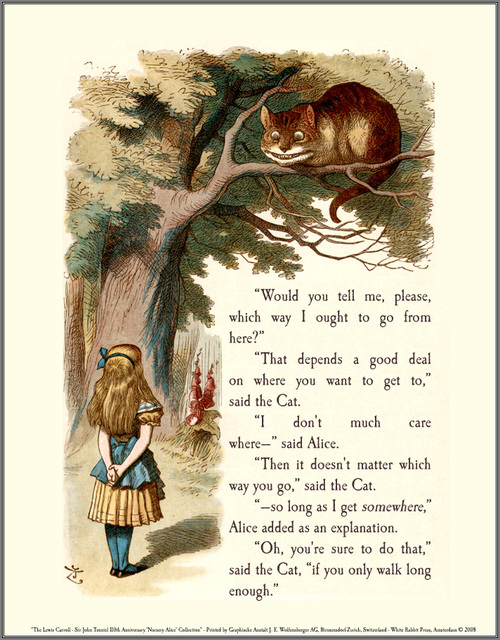

“Would you tell me, please, which way I ought to go from here?”

“That depends a good deal on where you want to get to.”

“I don’t much care where.”

“Then it doesn’t much matter which way you go.”

- Alice in Wonderland, Lewis Carroll

The above exchange between Alice and the Cheshire Cat is one of Lewis Carroll’s most quoted phrases, and is much beloved of strategists the world over. Like any great truth, it is stunning in its simplicity, but at the same time, it is a basic axiom that the best of us can fail to follow.

An effective strategy is the single biggest difference between the success stories and the failures in the Forex market. Trading is chaotic, and it’s easy to get carried away and stray from your course even when you do have a solid plan of action in front of you. If you don’t, your trading will descend into chaos and you will rapidly lose your money, it is that simple.

2) The right software

What is the best forex trading software?

The smartphone and mobile technology age can lull us into a false sense of security. Download an app, and everything will be OK – it is the ultimate 21st century panacea. There are numerous trading platforms out there that you can use on your PC or smartphone, and they all have their pros and cons. But it is not just a case of having the means to make the trade, you also need the analytical tools. If you have the best Forex prediction software at your fingertips, you can do more than just analyze trends and jump on bandwagons, you can see when a change is coming and know when to go against the flow. And ultimately, that is how the best traders really make their money.

Take your time choosing the best platform, and really dig into the pros and cons. Also speak to other traders to check what online resources they use. This is your workplace, and you need it to be just right.

3) Information

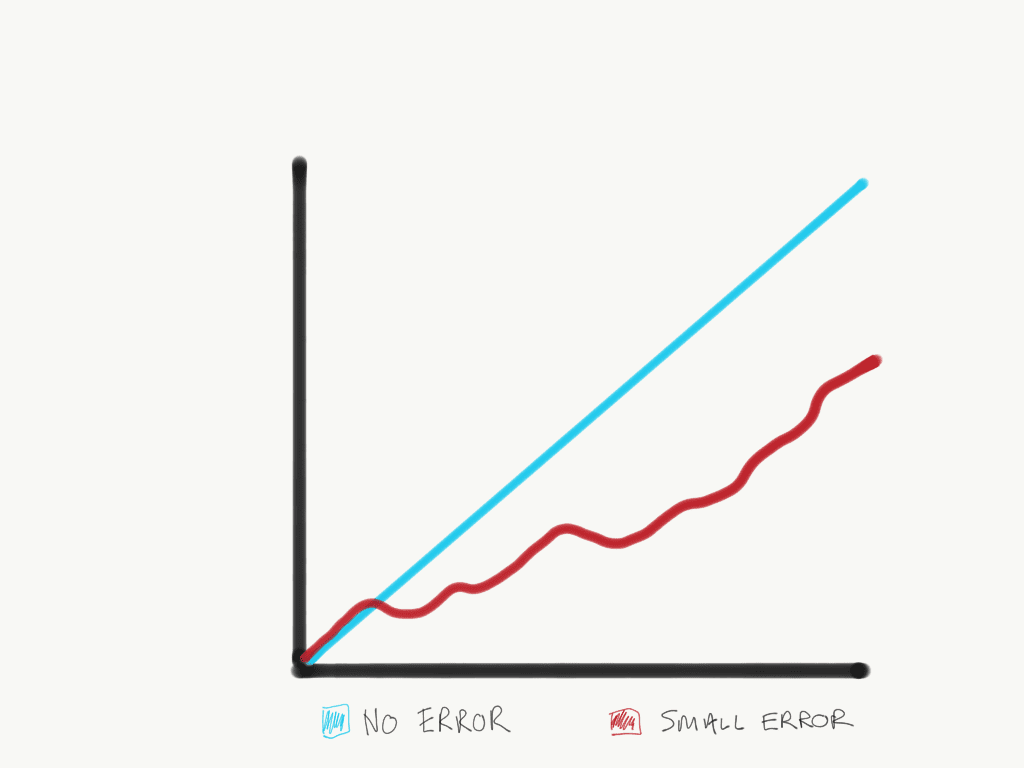

The Butterfly Effect: Everything You Need to Know About This Powerful Mental Model

Chaos theorists love talking about the butterfly effect, where a small input somewhere causes a major output at a later stage. You can see it on a crowded highway in the rush hour. One driver just touches his brake pedal for a second, the car behind brakes, a ripple effect begins at the sight of the brake lights and a mile back, all five lanes come to a standstill.

The butterfly effect is an important thing to understand for Forex traders, because you never know what is going to have an effect on a currency pair’s value. A change in interest rates is obvious, but what about an ill-worded speech by a politician that might reduce consumer confidence, or a sudden weather event that brings the construction sector to a temporary halt?

Successful Forex traders should probably consider adding to their revenue streams by taking part in TV game shows, as their breadth of general knowledge is usually impressive – it has to be, as world events that might seem insignificant can all feed into the knowledge bank that is used to inform the next trade.