Linkhouse Books are powerful guides for anyone eager to shape their financial journey. Each book offers knowledge from experts who have tested and perfected their financial wisdom. Online libraries offers valuable insights for making informed financial choices, giving readers access to resources that deepen their understanding of financial strategies. With the right books, you gain the ability to approach finances in an informed, balanced way, making choices that align with your personal goals.

How Books Build Financial Literacy

Books often become a critical part of personal financial growth because they provide clarity in a complex area. Rather than relying on occasional advice from articles or friends, a well-chosen book offers a deeper perspective on budgeting, investing, and planning for the future. Exploring different authors allows you to weigh diverse viewpoints and develop your unique approach to money management. Readers often find the structure of books empowering, as each chapter takes them through new ideas step-by-step. This structure transforms confusing topics into clear paths and shows how small actions can drive long-term financial success.

Finance books do more than inform; they help readers create real change in their financial outlook. Unlike brief articles or social media tips, a book’s depth encourages readers to pause, reflect, and genuinely apply new ideas to their lives. As financial literacy builds, decisions around budgeting and investing gain a meaningful context. Financial literacy from books isn’t just for adults; teens and young adults, too, can learn to approach their finances early, setting a foundation for responsible money management and wise choices.

Books as Practical Guides for Financial Goals

Books offer straightforward, actionable strategies, making them valuable assets in achieving financial milestones. Through authors’ experiences, readers gain insights into common financial hurdles, such as managing debt, building savings, and developing investment portfolios. Learning directly from those who faced similar challenges provides realistic solutions for everyday issues. Here’s a look at how books can transform financial strategies:

- Building a Budget: A solid budget is the starting point of any financial journey. Books provide step-by-step guidance on managing income and expenses with a practical approach.

- Saving for the Future: Many books outline savings strategies that help secure future goals, from emergency funds to long-term plans.

- Understanding Investments: Investing can seem daunting. Books demystify the stock market, real estate, and other areas, helping you start investing with confidence.

- Managing Debt Wisely: Debt can hold you back, but financial books offer methods for reducing debt gradually and effectively without overwhelming your budget.

- Embracing Financial Discipline: With discipline as a theme, many books share habits that build a stable financial future, encouraging responsible spending and regular saving.

Books foster a deep understanding of these areas, setting the foundation for a balanced financial approach that supports growth and security.

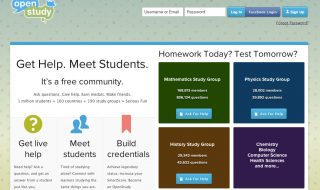

Why E-Libraries Like ZLibrary Are Essential in Financial Learning

In our pursuit of financial knowledge, z library offers easy access to books covering every financial topic imaginable. E-libraries provide a convenient way to access resources without the limitations of physical libraries. With digital platforms, a vast range of finance-focused books are available, and each book offers distinct insights. This accessibility plays a vital role, particularly for readers who may have time constraints or live far from traditional libraries. Through e-libraries, readers can explore topics as varied as investing in foreign markets to understanding credit, empowering them to make well-informed choices.

E-libraries often make it easier to find books that align with personal interests and financial goals. Rather than browsing physical shelves, you can easily discover titles tailored to your specific needs, whether you’re learning about retirement planning, tax strategies, or simply trying to manage monthly expenses more effectively. This convenience adds a layer of practicality, as readers can jump directly into sections relevant to their needs, creating a faster path to knowledge and financial independence.

Embracing Books for Lifelong Financial Success

The journey toward financial security is rarely quick or straightforward, but books serve as steady companions in this pursuit. As you continue reading and learning, each book contributes to a broader understanding of finances, helping you make wise decisions along the way. Whether you aim to grow your wealth or maintain a stable financial base, books give you access to timeless wisdom, guiding you toward your unique financial vision. E-libraries offer convenient, accessible ways to dive into this world of knowledge, making each page a step closer to your financial goals.