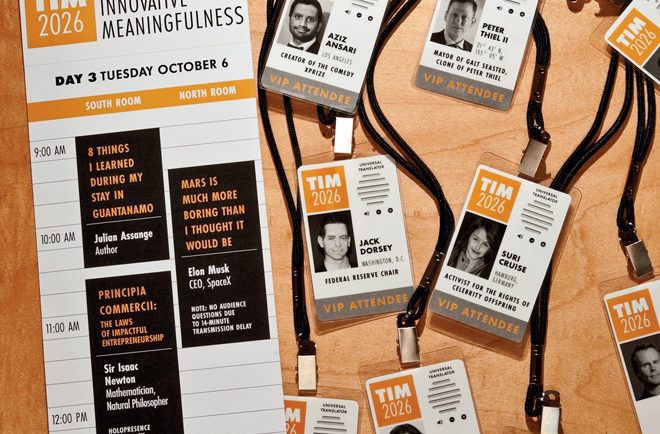

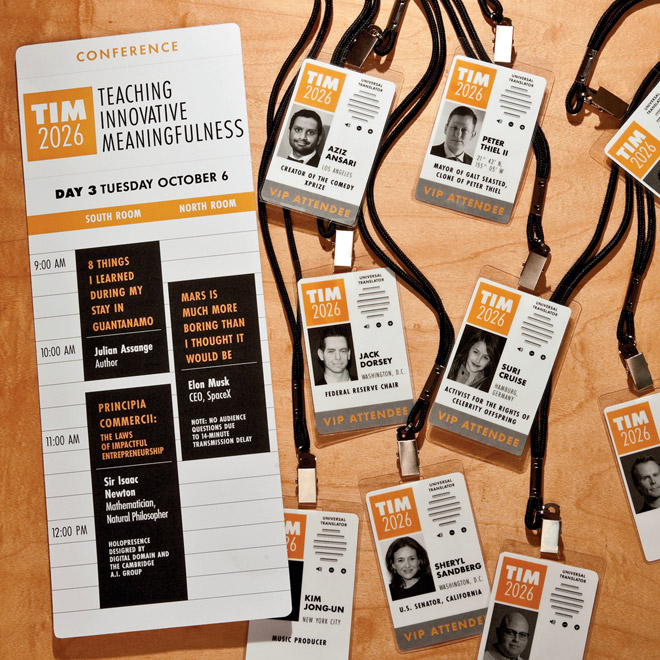

As businesses move into the impersonal online space, how can they know that people really are who they say they are? This is the root of the current identity verification crisis facing anyone and everyone trying to do business via the web.

Under US law (specifically the PATRIOT Act), companies have an obligation to conduct due diligence on the people they do business with. Noncompliance such as transacting business with someone using a stolen identity or someone on a government register can result in massive fines. This alone is reason enough to get a bona fide ID verification solution in place.

In spite of this, there’s widespread disbelief among small businesses with one recent article suggesting 48% of businesses think they’re not big enough to be targeted for fraud.

The rising threat of online fraud

Online fraud continues to increase year-on-year. Criminals are finding new ways to exploit businesses and consumers all the time. One of the most alarming recent trends has been the sharp rise in synthetic fraud where fraudsters use fragments of real data to create new synthetic identities. New crimes like these are more difficult to detect and necessitate a more rigorous ID verification process to reduce business risk and ensure regulatory compliance.

Streamline your ID verification

Getting stricter ID verification solution in-place should be seen as an opportunity as well as a challenge. Automated software obviates the need for a lengthy manual submissions process. In the past, getting third-party verification for an employee, a customer or a client involved sending documents back and forth, completing lengthy forms and taking out time to vet someone in-person.

More to the point, the best automated processes are capable of verifying identity to a higher degree of accuracy than their human counterparts. More likely than not, they’ll also be able to do this more quickly too and at a greater scale.

The bottom line: you can leverage digital programs to prevent fraud with ID verification and streamline the process into the bargain.

Know your customer

Customers will be put off by an onerous verification process. Recent research from PWC has shown that consumers value convenience and speed above all else. The last thing they want is a rigmarole.

At the same time, a recent report from Experian found that one of the most common reasons for abandoning transactions was a perceived lack of security. This fear has roots in the frightening proliferation of online identity fraud.

When it comes to customers, the evidence suggests there’s a balance to be struck between a Know Your Customer (KYC) process and limiting invasive and time-consuming checking practices.

Move with the times

As cybercrime increases in sophistication, so must you. As well as shoring your outfit up against identity fraud (and the massive related fines) a stricter verification process will offer improved protection for your employees, customers, and clients. Whatever the size of your business, there’s never been a more urgent time to invest in proper identity verification.