How Gold is Traded

There are many advantages to trading gold that appeal to both experienced and novice traders. Gold can generate great opportunities for profit in most market environments and can handle bull markets as well as bear. Gold has always been a major player in the world’s economy and valued as a precious resource. While many of those players, both private and political, own the metal outright, you can keep your risk to a minimum and take advantage of the leverage that exists when speculating through options, equity and futures. The way to get started with gold trading begins with a good understanding of the gold markets and knowing where you can go wrong. Don’t forget that gold is unlike any other market. It has special qualities that you can profit from if you understand where the pitfalls lie. As with all trading, learn before you leap! Spend time understanding gold before taking the first step.

Where is all the Gold?

What is the Relationship Between Gold and Gold ETFs? (GLD, IAU)

The truth is that everyone wants gold. And not just to trade gold, but to own a chunk. However, when trading gold, you must consider those people who buy physical gold and store it. Whether it’s to safeguard their assets, to save as an inheritance to pass on to the generations to come or as an investment, you must take them into account when watching gold fluctuations. Many of these traders are retail dealers who add liquidity to the gold market while providing buying interest at reduced prices. Institutions are likely to use gold as a hedge. They’ll buy and then sell “risk-on” and “risk-off” by combining the deal with bonds and currencies in bilateral strategies.

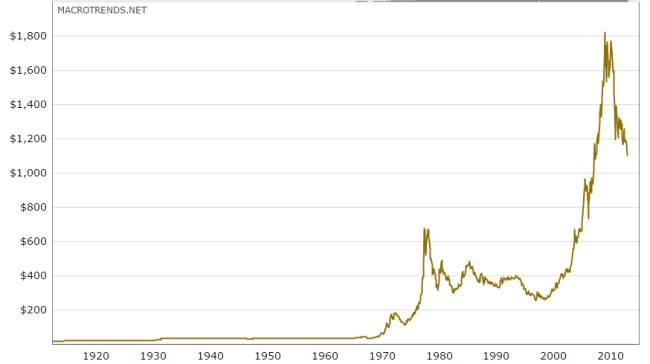

Reading the Gold Charts

Learn How To Trade Gold In 4 Steps (GLD, GDX)

Just like any trading, you must understand the gold chart from top to bottom. Go back in time over the last few decades to see what moves the value and how the market reacts. Identify trends, watch price levels and know which indicators to look for when ready to buy or sell. Compare prices to inflation, monetary policies and government fluctuations. The more you learn before you begin trading gold, the better your chances will be at turning a profit.

Learn What to Watch

Everyone the world over is interested in gold. It’s a commodity that everyone covets, which makes it unique. But you need to find out what the conditions are that move gold; what are the market indicators that you can watch for that will give you clues in regard to buying or selling? For instance, what do you do if you see gold prices suddenly sky rocketing and everyone wants to be a part. Is that the best time for you to blindly join the race? Knowing what triggered the race will help you anticipate when to join. Some of the market moves to identify are inflation/deflation, greed/fear, supply/demand. Then decide if you’re going to enter the futures markets or stick with equities.

Learning which events impact gold buying and selling will help you minimize your risk and increase your chances for solid profits.